Trump’s tariffs sink U.S. stock market

San José, CA – On Thursday, April 3, one day after Trump’s newest tariffs announcement, prices did start to fall as candidate Trump promised. The only problem is that it was the prices of stocks, not groceries.

News and Views from the People's Struggle

San José, CA – On Thursday, April 3, one day after Trump’s newest tariffs announcement, prices did start to fall as candidate Trump promised. The only problem is that it was the prices of stocks, not groceries.

San José, CA – On Monday, March 10, U.S. stock markets fell. The S&P 500, which includes 500 of the largest U.S. corporations, dropped 2.7% for the worst trading day of the new Trump administration. The NASDAQ, which is over-weighted in technology stocks, fell even more, dropping 4% as high-flying technology stocks continued their descent to earth. Both the broader market and the technology sector were led down by a 15% drop in Tesla share prices, bringing that stock down about 50% from its high just months ago.

San José, CA – On Friday, February 21, all the major U.S. stock indices fell. The broadest measure, the S&P 500, dropped more than 100 points. What scared the stock markets were a pair of indicators showing signs of rising inflation and a slowdown in the economy, which is commonly called stagflation.

San José, CA – The decline in U.S. stock prices accelerated on Monday, August 5, with the broadest measure of large corporate stocks, the S&P 500, falling more than 160 points or 3%. Fears of a recession contributed to declines in stock prices around the world.

San José, CA – On Monday, May 9, U.S. stock prices continued to fall, with the broadest index, the S&P 500, losing more than 3%. This is the biggest one-day drop in stock prices since the onset of COVID in the United States in early 2020. The S&P 500 has fallen 17% since hitting an all-time record high in late March. This is approaching the 20% drop that is labeled a “bear market.” Stock prices of high-tech companies have fallen even more, with the technology-heavy NASDAQ index already in bear market territory.

Biggest one-day drop since 2020

San José, CA – On Friday, April 22, U.S. stocks fell more than 2.5%, with the Dow Jones Industry Average, dropping almost 1000 points. This led to the third week of losses for U.S. stocks, as a combination of recession fears – based on slowing corporate sales and profits, combined with the reality of higher interest rates – influenced investors.

Chicago, IL – The past few days have seen GameStop and Reddit become the meme-of-the-week and take significant headlines. Some media outlets are saying the recent turn of events “isn’t funny; it’s stupid” while celebrity billionaires like Elon Musk crack jokes on Twitter. Redditors are claiming that they are crashing Wall Street, and yet the market is bullish as ever. What should we be taking from all of this? In short, we must seize this moment to educate about how the stock market works, who it works for, and how we can institute true changes that benefit everyday people.

San José, CA – For the second month in a row, U.S. stocks fell in October. The drop in stock prices sped up, with both October and the last week being the worst month and week for the stock market since March. The broadest stock market index, the S&P 500, is now down nearly 9% from its record high in early September.

San José, CA – On Thursday, September 3 the U.S. stock market took its biggest fall since in three months. The Dow Jones Industrial Average dropped more than 800 points, or almost 3%. The broader S&P 500 index fell more than 3%, while the tech heavy NASDAQ index fell almost 5%. All of these measures of the stock market had been at or near record highs until their share drop.

Stock market near record high

San José, CA – With the additional $600 in unemployment benefits gone along with federal eviction protection, President Trump announced that a deal to restore the benefits and protect renters and home buyers “is not going to happen.” With tens of millions of people getting government aid, tens of thousands of evictions underway, and record numbers of people short on food, Trump’s statement may seem so beyond uncaring as to be almost senseless.

Over the last 8 weeks more than 40 million have lost their livelihood

San José, CA – On Thursday, May 14, the Labor Department reported more bad news, saying that almost 3 million people applied for unemployment insurance in the previous week ending May 9. This means that over the last eight weeks more than 36 million people applied after losing jobs and income. Another 3.5 million are collecting the federal government’s Pandemic Unemployment Assistance, or PUA, which goes to the self-employed. This brings the total number of recently unemployed people to about 40 million.

Trump and Republican governors try to force workers back to unsafe jobs

San José, CA – On Thursday, April 30, the U.S. Department of Labor reported that more than 3.8 million new claims for unemployment insurance or UI were filed in the previous week ending April 25. This means that over the last six weeks more than 30 million claims have been filed. This means that the actual unemployment rate is about 25%, a level similar to the worst of the Great Depression of the 1930s.

New claims for Unemployment Insurance now total 27 million over the last 5 weeks

San José, CA – More than 4 million more Americans filed for Unemployment Insurance, or UI, benefits last week according to the latest Labor Department report on Thursday, April 23. This brings the total number of new claims over the last five weeks to 27 million.

San José, CA – Earlier in the day, I glanced at oil prices and saw that they were down 40% for the day at about $10 a barrel. Pretty bad, I thought. Then after financial markets closed, I got a call about it. I looked and saw that the closing price was negative $37.63 and let out an f-bomb, the first of about a half a dozen in my three minute conversation.

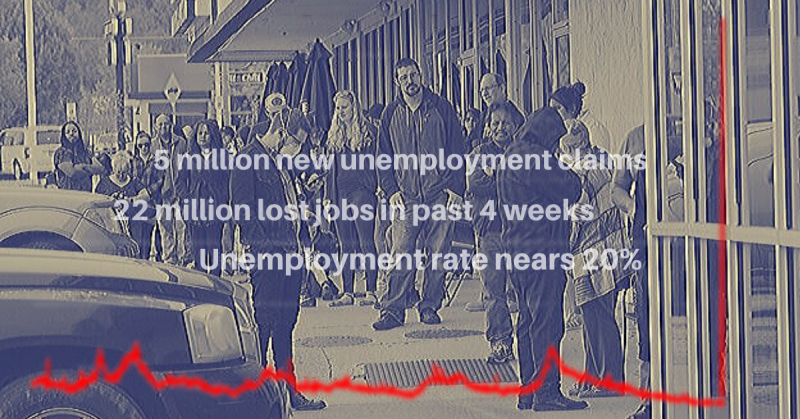

Unemployment rate heading to 20% in April

San José, CA – On Thursday, April 16, the U.S. Department of Labor released their latest report on new claims for unemployment insurance, or UI, benefits showing 5.2 million more people applied. This means that more than 22 million people have lost their livelihood in the last four weeks. The number of people actually collecting unemployment insurance benefits soared to 12 million, the highest ever.

Unemployed line up for miles at food banks and millions skip paying rent

San José, CA – For the second week in a row, the U.S. Department of Labor reported April 9 that more than 6 million people applied for unemployment insurance in the previous week. The Labor Department also revised up last week’s claim numbers to 6.6 million, meaning that a total of 16.8 million people have lost their jobs and applied for UI benefits in just the last three weeks. The actual number could be higher as many states’ websites, phone lines and paper application sites were swamped.

_Unemployment rate jumps in April _

San José, CA – The headline news that the unemployment rate for March jumped by almost a full percentage point, to 4.4%, was bad enough. The actual unemployment rate was much higher by the end of March, given that the more 10 million people who lost their jobs and filed for unemployment insurance benefits in the last two weeks of March were not counted. Adding in these workers would have increased the unemployment rate by more than 6%, raising the total rate at the end of March to about 10.5%.

Businesses slash 700,000 jobs in the first half of March

San José, CA – On Friday, April 3, the U.S. Department of Labor reported that businesses cut more than 700,000 jobs last month. This report was based on surveys from the first half of March, before the full impact of the COVID-19 pandemic hit. This ended the longest streak of job gains – almost nine and a half years – and almost certainly marked the beginning of a recession.

A new record of 6.6 million Americans apply for benefits

San José, CA – New claims for Unemployment Insurance (UI) benefits doubled from record numbers just a week earlier. On Thursday, April 2, the Department of Labor reported that more than 6.6 million people applied for state unemployment insurance benefits for the week ending March 28. This means that almost 10 MILLION people lost their jobs and applied for UI benefits in just the last two weeks of March. This economic crisis has caused more job losses in two weeks than the entire 2007 to 2009 recession, where 8 million jobs were lost.

Federal Reserve takes extreme measures to protect wealthy

San José, CA – Last week the financial news was dominated by the falling stock market, which had its worst week since the 2008 financial crisis. But behind the scenes the U.S. Federal Reserve, or Fed, was working feverishly to prevent another financial crisis, taking actions not even done during the 2008 crash.