Chicago budget fight sees corporate interests clash with working-class coalition

Chicago, IL – Corporate-backed alderpersons pushed through an unbalanced budget to avoid taxing big businesses on Saturday, December 20, but conceded important measures after sustained pressure from working-class Chicagoans.

The final budget package, championed by conservative council members, promises to sell to private debt collectors nearly $100 million debt from water bills, parking tickets and ambulance fees. It also increases liquor and gambling taxes and sells city spaces for advertising. These measures, which have been assessed as fiscally irresponsible by the city’s budget experts, are the last ditch effort by the group of oppositional alderpersons who have fought to avoid instituting a corporate head tax, in which the largest 3% of corporations would pay less than a thousandth of a percent of their profits based on the number of workers they employ.

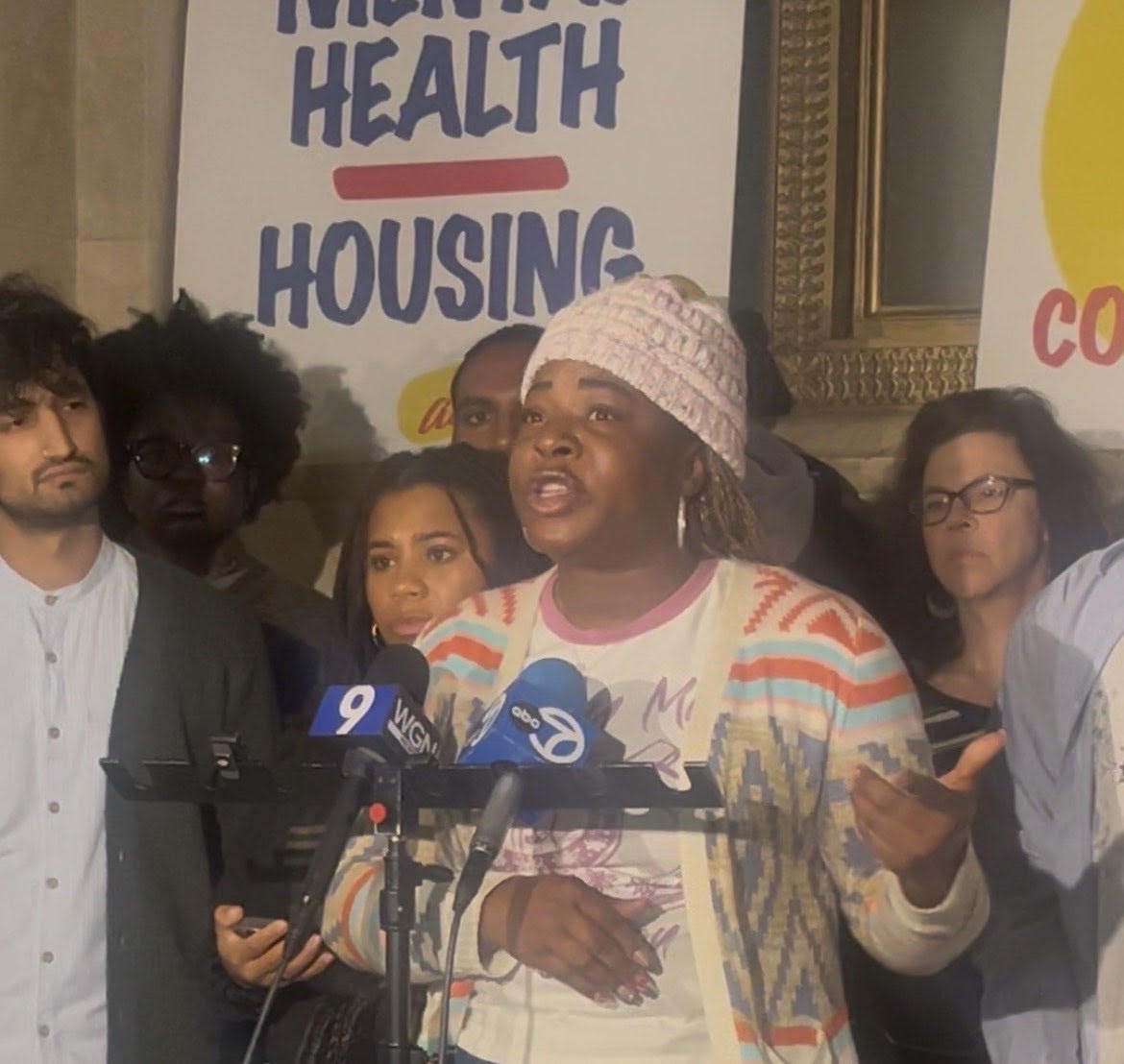

“If aldermen really listen to the solutions that the people got, we would be in a better Chicago,” said Jasmine Smith, a co-chair of the Chicago Alliance Against Racist and Political Repression (CAARPR).

This wave of reactionary economic policy in Chicago mirrors the sweeping economic cuts to SNAP, health care and public transportation imposed by Donald Trump in his spending plan. Companies like McDonald’s and Google that would have been asked to contribute to the corporate head tax are the same companies that saw record tax breaks from Trump.

“Our federal government is led by a money hungry, immoral, unaccountable exec branch, a bloodthirsty Department of War, and a cowering judicial branch,” said Itohan Osaigbovo, an organizer with the Chicago Black Voter Project who knocked hundreds of doors to talk with Chicagoans on the South and West Sides about the budget. “This is not your typical budget year in Chicago,” she said.

“This alternative budget treats poverty as a business model,” said Rocio Garcia, a leader with the Grassroots Collaborative and the People’s Unity Platform. “You cannot fine your way to financial stability.”

Avoiding the tax on corporations in favor of predatory and irresponsible alternatives will likely lead to a budget crisis halfway through the year, according to leaders of the Public Health and Safety Coalition (PHS).

Countless hours of knocking doors, making calls and pressuring alders created the conditions for Mayor Brandon Johnson to propose a budget that included a tax on large corporations, cuts to CPD vacancies, year-round funding for the youth job programs that have brought Chicago crime to historic lows, funding for the Chicago Department of Public Health, and funding for non-police crisis response and mental health centers, PHS organizers said.

When corporate interests and the alderpersons that represent them came forward with their original alternative proposal on December 15, they sought to slash youth jobs and increase the city garbage tax in order to balance the budget. Working-class and oppressed Chicagoans responded, making thousands of calls and knocking doors in the winter cold to fight back against these regressive measures.

Within days, the alternative budget was amended to remove the garbage tax increase and restore funding to youth jobs. Additionally, the alternative budget still includes cuts to 500 vacant Chicago Police Department positions, funding for public health and non-police crisis response.

#ChicagoIL #IL #PeoplesStruggles #CAARPR #Housing #SNAP #Transportation